unemployment tax forgiveness pa

My husband offered to co-sign a car loan for a coworker he considered a friend. To qualify tax return must be paid for and filed during this period.

Propertytaxrebate Form Fill Out Sign Online Dochub

2301 This section allows employers a payroll tax credit for 50 of the wages paid to employees up to 10000 per employee during any period in which such employers were required to close due to COVID-19 ie.

. Engine as all of the big players - But without the insane monthly fees and word limits. In some states PA is an example employees also pay in to the fund via a mandatory payroll deduction. To qualify tax return must be paid for and filed during this period.

Over 500000 Words Free. On the day they went to purchase the car they signed some paperwork with sales and financing and the coworker drove the car off the lot without making a down payment and without insurance which you can do in Florida apparently. Pennsylvania offers assistance and other services to people and families in need.

For purposes of completing Line 2 the under collections deducted from later payments are treated as a non-reportable reimbursement of the tax paid by. The Jerusalem Post Customer Service Center can be contacted with any questions or requests. Cyclical behavior of exports and imports.

B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not. According to Goodwin when unemployment and business profits rise the output rises. Income is an essential determinant of the level of imported goods.

Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US. Tool requires no monthly subscription. Temporary delay of designation of.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Watch CBS News live and get the latest breaking news headlines of the day for national news and world news today. 2421 Extension 4 Jerusalem Post or 03-7619056 Fax.

Determine the amount of Pennsylvania-taxable income. And increasing Medicaid funding. News about political parties political campaigns world and international politics politics news headlines plus in-depth features and.

Due date of return. Publication 3 - Introductory Material Whats New Reminders Introduction. Content Writer 247 Our private AI.

Eligibility Income for Tax Forgiveness Purposes While active duty pay and active duty for training pay received by a member of the US. It actually is because unemployment is paid for by the taxes from your most recent employer. Armed Forces is not taxable for Pennsylvania personal income tax purposes a taxpayer must include such compensation when determining eligibility for tax forgiveness on PA-40 Schedule SP.

What is the difference between the Property Tax and Rent Rebate ProgramProperty taxes paid by an owner on their home. Suspension of tax on portion of unemployment compensation. Emergency assistance to families through home visiting programs.

Included in that package is an additional 284 billion in PPP funding but significantly reduced stimulus checks and unemployment benefits compared to the first round of COVID relief. This is not entirely accurate. Pennsylvania Form PA-40 ESR is used to pay estimated taxes.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. The employer reports the correct amount of tax required to be withheld on Line 2 Total PA Withholding Tax of Form PA-501 Employer Deposit Statement and remits the withholding tax.

May not be combined with other offers. This subtitle allows certain employers tax credits and other tax benefits to compensate them for losses due to COVID-19. Offer period March 1 25 2018 at participating offices only.

A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020. Exports and imports are large components of an economys aggregate expenditure especially one that is oriented toward international trade. On PA-40 Schedule SP the claimant or claimants must.

While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would lead to lower. News about the White House Congress and the Federal Government. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbiaeven if you dont live in.

Offer period March 1 25 2018 at participating offices only. Download Pennsylvania Form PA-40 ESR from the list of forms in the table below on this page. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return.

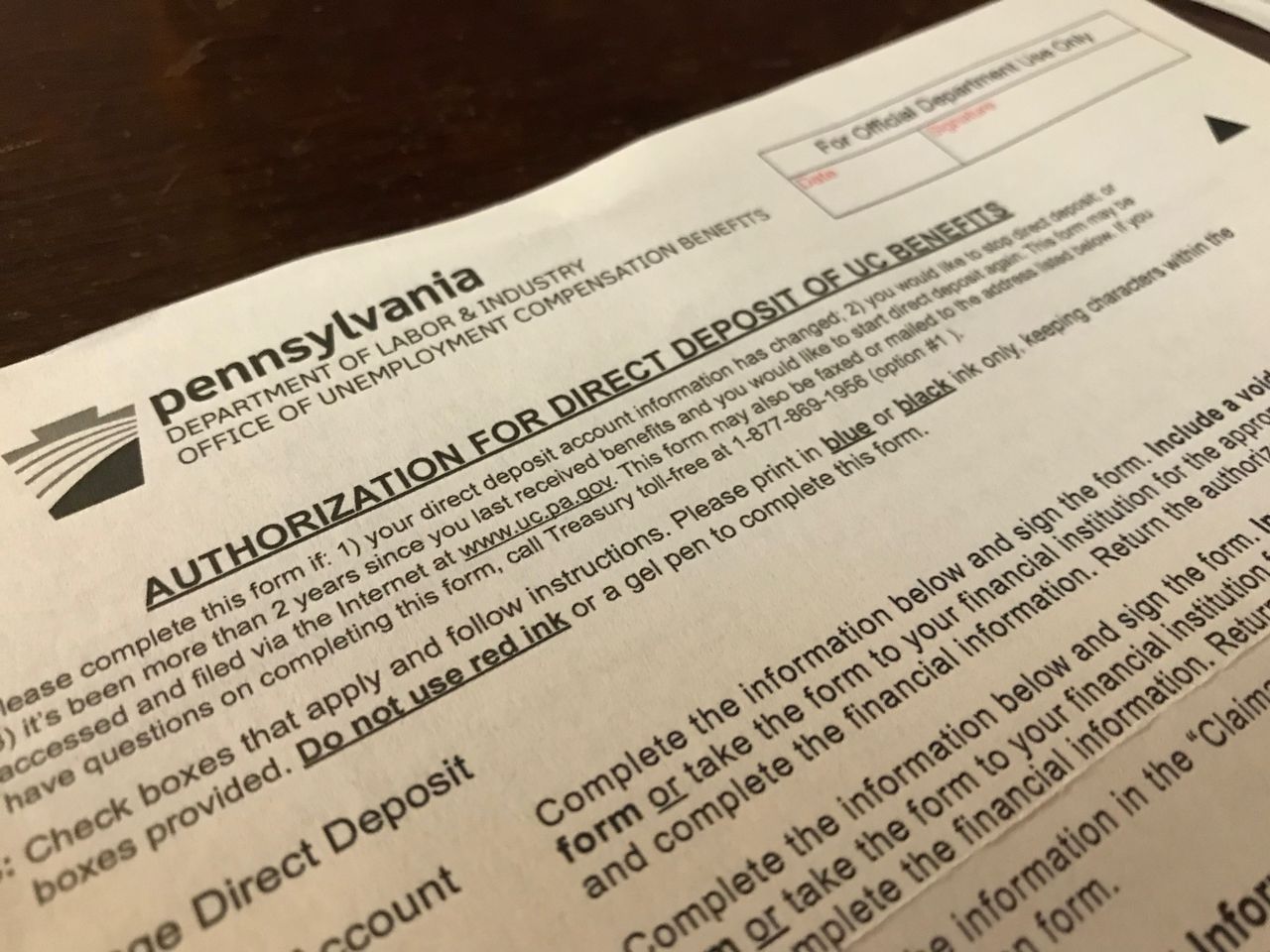

Modification of treatment of student loan forgiveness. If you have taxable income from self-employment interest dividends unemployment compensation and pensions you may have to pay estimated tax to the state of Pennsylvania. How do I close my Revenue Accounts Sales UseTax Employer Withholding Public Transportation Assistance Fund Taxes Vehicle Rental Tax and Tobacco Taxes.

May not be combined with other offers. How do I know if I qualify for the Property TaxRent Rebate. Thats because the loan forgiveness rules only required businesses to use 75 percent of the money for payroll costs and do not require them to prove that.

Watch the latest news videos and the top news video clips online at ABC News. This bill responds to the COVID-19 ie coronavirus disease 2019 outbreak by providing paid sick leave tax credits and free COVID-19 testing. Subtitle B--Emergency Assistance to Families Through Home Visiting Programs Sec.

Expanding food assistance and unemployment benefits. In most states employers pay into a state unemployment compensation insurance fund. 116-127 03182020 Families First Coronavirus Response Act.

File Form 1040 or 1040-SR by April 18 2022.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Benefits Tax Issues Uchelp Org

Pa S Unemployment Trust Fund Is Broke The Wolf Admin Says A Long Term Fix Will Save Taxpayers Millions Pittsburgh Post Gazette

Unemployment Benefits Deal To Waive Taxes On First 10 200 Of Ui

Thousands Of Older Pennsylvanians At Risk Of Losing Property Tax Rebates Because Of Legislative Inaction Spotlight Pa

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Federal Unemployment Benefits End Here Are The Pandemic Assistance Programs That Can Still Help

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Unemployment Benefits Tax Issues Uchelp Org

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Pennsylvania State Tax Software Preparation And E File On Freetaxusa

/1099g-b89de84cce054844bd168c32209412a0.jpg)